FLSA – Salary & Compensation Thresholds

Nov 1, 2024ALBANY, NY | On April 23, 2024, the United States Department of Labor (“DOL”) announced its final rule that raised the salary threshold for certain professional employees to be classified as exempt from federal overtime pay requirements under the Fair Labor Standards Act (“FLSA”)1https://www.dol.gov/agencies/whd/overtime/rulemaking. Effective July 1, 2024, the standard salary level for executive, administrative, and professional exempt employees will be set at $844 per week. This amount will automatically increase to $1,128 on January 1, 2025. Additionally, the annual compensation threshold for the highly compensated employee exemption will rise to $132,964 on July 1, 2024, and will subsequently increase to $151,164 on January 1, 2025. It’s important to note that employers should be aware of the specific state threshold requirements in case they exceed the federal standards, as compliance with both federal and state laws is necessary.

The Fair Labor Standards Act

Under the FLSA, which controls the federal wage and hour law, employers are required to pay employees a minimum wage as well as overtime pay to employees who work more than 40 hours in a 7-day workweek at a rate of at least 1.5 times an employee’s regular rate of pay. Further, the FLSA exempts certain employees from its overtime pay requirements if they meet the criteria of specific exemptions outlined in the Act. Simply paying an employee on a “salary basis” does not automatically qualify them as exempt. Exempt employees must also generally perform specific types of work to be classified as exempt. In addition to meeting the minimum salary requirement, executive, administrative, and professional employees (“white collar professionals”) and highly compensated employees (“HCE”) must also fulfill the relevant “duties test” established by the FLSA. 2https://www.dol.gov/agencies/whd/fact-sheets/17a-overtime The new rule does not change the content of the applicable white-collar exemption “duties tests.”3Link to section of DOL website that provides a variety of duties tests based on area of employment – https://www.dol.gov/agencies/whd/fact-sheets/17a-overtimeRather, the new rule focuses on the salary and compensation thresholds for these exempt employees.

Current Salary & Compensation Thresholds

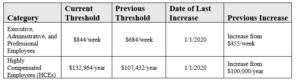

As the table below indicates, the current salary threshold for executive, administrative, and professional employees is $844 per week, an increase from the previous $684 per week salary threshold. The current threshold for highly compensated employees is $132,964 per year, an increase from the previous $107,432 per year salary threshold.

Here’s the information organized into a table format:

**Notes:**

The $455 weekly salary level and $100,000 annual compensation threshold were established in 2004 and remained unchanged for 16 years.

Revised Salary & Compensation Thresholds

Under the new revised salary and compensation thresholds provided in the FLSA, there are three main changes to the FLSA exempt rules:

- The new rule increases the salary for white collar exempt employees from $844 per week to $1,128 per week effective January 1, 2025;

- The new rule increases the minimum total compensation threshold for highly compensated exempt employees from $132,964 to $151,164 effective January 1, 2025; and

- The new rule automatically updates the salary levels beginning July 1, 2027, and every three years thereafter, using then-current wage date to determine the increases.

The new rule indicates an increase of nearly 65% in the minimum exempt salary threshold by January 1, 2025, and an almost 40% rise in the minimum compensation threshold for HCEs. Further, the DOL estimates that at least 4 million workers will be affected by this final rule by 2025.

Final Takeaways

With the impending changes to the rule, it is crucial for all employers with salaried workers to act swiftly. Given the broad scope of employees affected by this new rule, it is imperative that employers conduct a thorough audit of the exempt status and salaries of all employees to ensure compliance with the Department of Labor’s final rule and overall exempt requirements. After this audit, employers must promptly decide whether to increase the salaries of any exempt employees who will not meet the new minimum salary thresholds by January 1, 2025, or to reclassify certain employees as non-exempt and eligible for overtime.

If the decision is made to increase salaries or reclassify employees, it is essential to comply with any relevant state law notice requirements. Document the changes in writing, have employees sign an acknowledgment, and ensure this acknowledgment is maintained in their personnel files. Time is of the essence—acting now will help avoid potential compliance issues in the future.

The Towne Law Firm, P.C. represents clients in all aspects of labor and employment law, from complex litigation to routine advice on human resource matters. Our attorneys are experienced in advising and representing employers and employees in a variety of work environments in both the private and public sectors in arbitration, negotiating, and representing clients in administrative hearings.

Share